Participants

About two weeks before each specific event, managers will be sent the names of the short listed investors. Please also see our brochure for names of past participants.

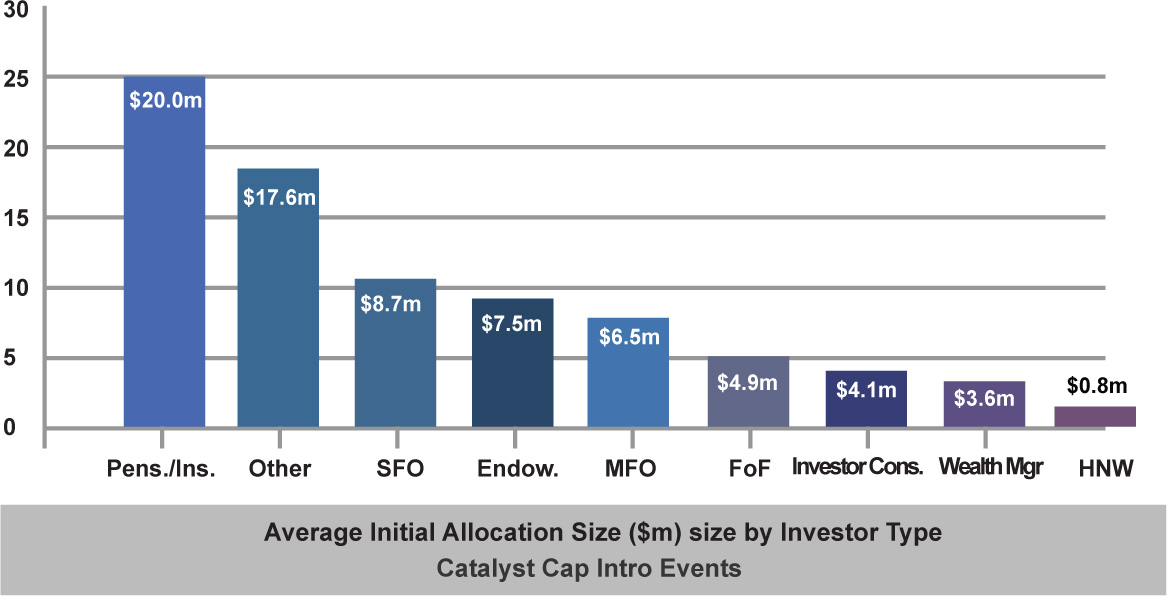

While the range of allocation sizes by investors can be large (a range between $1-$25m is common), the majority of investors has an average initial allocation size between $5-$10m.

HNW individuals allocations are smallest at below $1m, and pension funds largest at $20m. Others investors (seeders, growth capital) indicate making large initial allocations as that is part of their business models with typically lower fees attached.

Investors are predominantly based in the North East US corridor (roughly Boston down to Washington), with 63% of the investors being based there.

22% of the investors come from the rest of the US, with 15% being international, mainly Asian and European based family offices and investor consultants.

At our cap intro events the largest share of investor representation is single and multi-family offices, constituting about 43% of the investors.

Investor consultants represent 14% and HNWs about 8%

Fund-of funds, RIAs and Wealth Advisors (and other multi-managers such as 40 Act funds) represent 24%.

Pension funds and insurance companies together represent 5%, with endowments at 6%.

The average AUM of an allocator is $2.5bn, with pension funds being the largest with $6.0bn in average AUM (in Alternatives).

In general, most investors’ average AUM ranges between $1-3bn. HNW individuals don’t usually disclose their assets so this is not available.

For reviews, see Stats & Reviews from one of our recent events.