The Catalyst Cap Intro Alternative Investing Funds – Kickoff 2022 is a pan-alternative asset classes and strategies event. The event is investor driven and transactional in scope, hosting investment managers and institutional grade investors that are introduced to each other with a view to become investment partners.

This Catalyst Cap Intro Event focuses on the Alternative Investing Funds space, kicking off 2022 with renewed ideas, anticipation and momentum. Strategies covered include: L/S equity & Long-only, Credit & Fixed income, Merger Arb, Event driven, Quant & Options, Currencies, Macro & CTAs, International/Global markets, Distressed & Deep-value, Commodities & Energy, and more. Managers typically offer their products through investment funds, but also SMAs or advisory features.

The event is live, in-person, where managers give presentations during lunch, followed by private meetings. The event concludes with a networking reception.

Participants are given access to a dedicated online Catalyst Event Portal, where the agenda, meetings schedule with contact info, participants list and other info are available. The event is exclusive with only around 30 participants in a controlled environment, with a 1:2 manager to investor ratio.

The introductions are arranged prior the events, in an investor driven fashion based on the merits of each investment manager and the requests made by the investors. There are no service providers, only managers and investors.

Investors are pre-screened and pre-qualified prior the events, by completing a COIN (Catalyst Online Investor Network) questionnaire. Investors constitute predominantly single and multi-family offices, allocator intermediaries, and end-investors, located in the US but also internationally.

This event production builds on Catalyst’s history and successful track record in putting together industry-recognized and effective capital raising events.

Special Event Considerations:

– This is scheduled to be an in-person event. However, please see our event terms at registration for possible changes and more information, and read our note on Update on Event Formats.

– The venue follows the ‘Key to NYC‘ policy guidelines, which means that all staff and event participants will be required to provide proof of COVID-19 vaccination before entering the premises.

The CIFA Foundation was created at the initiative of a group of financial entrepreneurs to face the increasing number of regulations and the growing complexity of markets. Its mission is to strengthen the role of independent financial advisors (IFAs) at the international level in order to better defend the interests of investors. CIFA has chosen Geneva, one of the world capitals of wealth management and headquarters of many international organisations, to establish its permanent organisation.

Learn more here

BarclayHedge, a division of Backstop Solutions, is a leading research based provider of information services to the alternative investment industry. Barclay began publishing fund data for CTAs and hedge funds in 1989 and currently maintains data on more than 26,000+ alternative investment vehicles. BarclayHedge provides access to its hedge fund, fund of funds, and managed futures databases to thousands of investors worldwide in Excel, Access, and formats compatible with most third party analysis packages. Barclay’s 31 hedge fund indices, 10 managed futures indices, and 7 UCITS indices are universally recognized as alternative investment performance benchmarks and are utilized by investment professionals around the globe.

Learn more here

IntegriDATA is a financial technology software company dedicated to helping the investment management industry improve operational efficiency and reduce risk. Founded in 2002 by financial industry experts, IntegriDATA specializes in expense allocation, payment automation, and collateral management solutions. IntegriDATA clients include hedge funds, private equity firms, fund administrators, institutional investors, and mutual funds. IntegriDATA software helps the investment management industry service over $1.1 trillion AUM as of November 2019.

Learn more here

The PRIVATEBANKING.COM wealth industry directory is the financial-industry’s leading online business development and networking platform focused on Wealth Management and Financial Services.

The platform offers effective marketing services and tools designed to achieve high brand recognition, broad visibility and reach to your products and services.

Privatebanking.com’s FINANCE LOUNGE business network is a vibrant and fast growingonline community designed to help financial markets professionals to build network, increase visibility and identify and stay in touch with relevant industry experts and customers alike.

We invite you to join the FINANCE LOUNGE and gain access to business insights and new connections across the globe: Please register at: www.privatebanking.com

Learn more here

Savvy Investor is a free research library for global institutional investors and service providers. We curate the best investment research from around the world, split into 50 topic categories for the ease of our members.

The site includes sections on Hedge Funds, Alpha Trading Strategies, Fixed Income and Treasury, and much more.

Visit today and join over 60,000 investment professionals who have registered worldwide.

Learn more here

SmartMoneyMatch connects the global investment community. It’s free to use and offers the following opportunities. Go to:

• Investments to browse and to list investment products.

• Request for proposal to list a Request for Proposals (RFPs) or to reply to one.

• Service providers to find investment service providers with the required expertise or to list your offerings.

• Events to search for and to announce events.

• Jobs to browse for jobs or to list your vacancies.

• Business Directory to find and connect with other professionals.

Additionally, all users have a company and a personal profile page where their activities or offerings—as an asset manager, investor, or service provider—are displayed.

Learn more here

Participants

About two weeks before each specific event, managers will be sent the names of the short listed investors. Please also see our brochure for names of past participants.

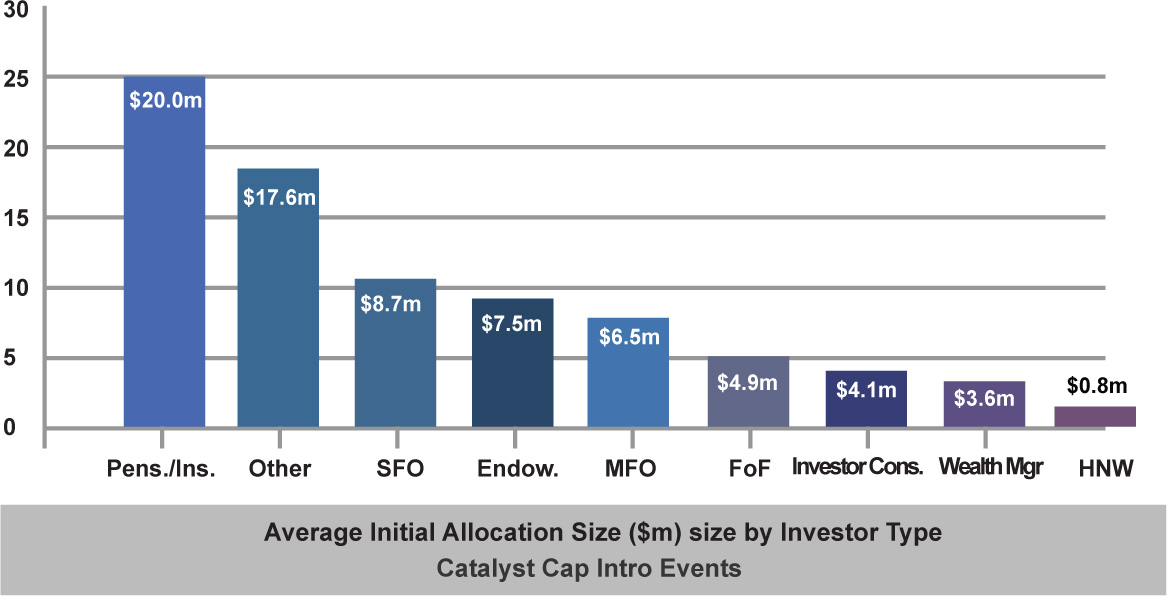

While the range of allocation sizes by investors can be large (a range between $1-$25m is common), the majority of investors has an average initial allocation size between $5-$10m.

HNW individuals allocations are smallest at below $1m, and pension funds largest at $20m. Others investors (seeders, growth capital) indicate making large initial allocations as that is part of their business models with typically lower fees attached.

Investors are predominantly based in the North East US corridor (roughly Boston down to Washington), with 63% of the investors being based there.

22% of the investors come from the rest of the US, with 15% being international, mainly Asian and European based family offices and investor consultants.

At our cap intro events the largest share of investor representation is single and multi-family offices, constituting about 43% of the investors.

Investor consultants represent 14% and HNWs about 8%

Fund-of funds, RIAs and Wealth Advisors (and other multi-managers such as 40 Act funds) represent 24%.

Pension funds and insurance companies together represent 5%, with endowments at 6%.

The average AUM of an allocator is $2.5bn, with pension funds being the largest with $6.0bn in average AUM (in Alternatives).

In general, most investors’ average AUM ranges between $1-3bn. HNW individuals don’t usually disclose their assets so this is not available.

Event fee: $2,990